I follow Matthew Kahn, now at USC, post on June 30 about the how the “Lucas Critique” undermines a recent study forecasting how counties across the U.S. might be affected differentially by climate change. Quoting the New Palgrave Economic Dictionary, “The ‘Lucas critique’ is a criticism of econometric policy evaluation procedures that fail to recognize that optimal decision rules of economic agents vary systematically with changes in policy.” In other words, individuals within the economy are able to anticipate changing events, including government decisions, and can mitigate the impacts of those events when compared to continuing with the status quo. Kahn puts great faith in the Chicago School premise that individuals can readily adapt to all conditions without government or collective decisions.

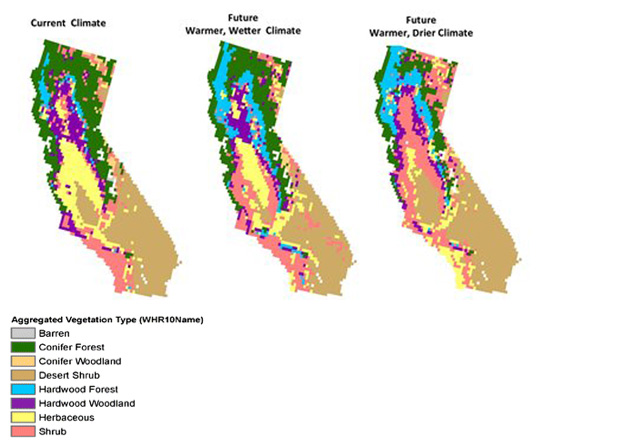

However, Kahn ignores two important points. First, he misses the distributional focus of the study, and instead focuses on the overall efficiency gains from the net changes. That’s not the point of the study. We can see on example that land can’t be moved from one county to another, so landowners can’t adapt in anticipation of climate change without significant investment to protect their land. Homeowners will lose value in their homes, and others will find their asset value stranded. Sure, the overall economy will adapt and certain counties may gain enough to offset those losses, but residents within the net loss counties will be worse off. Economics for too long has focused solely on net gains without parsing the impacts and considering how to manage better outcomes for the losers. (I see this failure as one aspect of dissatisfaction driving Trump voters–which brings me to my second point.)

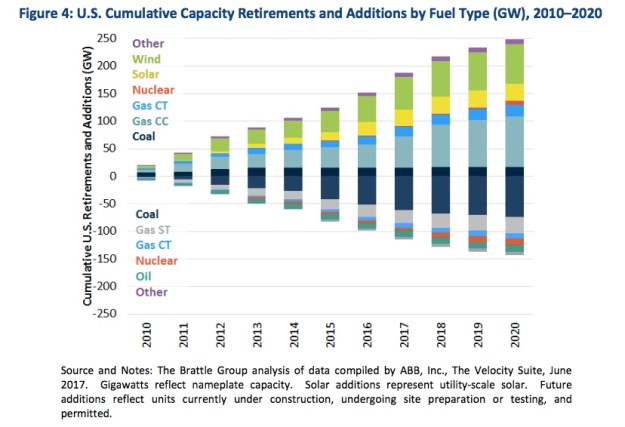

And second, if the Lucas Critique was truly valid, coal miners in Appalachia would have long abandoned their towns as they saw the decline of coal, and the need to satisfy West Virginia coal miners would not be driving national policy today. Instead, we see that people are myopic and these changes are likely to have significant consequences.