Installed wind capacity is more than 82,000 MW, according to a trade group, making it the nation’s largest renewable resource ahead of hydro.

Installed wind capacity is more than 82,000 MW, according to a trade group, making it the nation’s largest renewable resource ahead of hydro.

Source: Wind capacity blows past hydro to become most plentiful US renewable | Utility Dive

Installed wind capacity is more than 82,000 MW, according to a trade group, making it the nation’s largest renewable resource ahead of hydro.

Installed wind capacity is more than 82,000 MW, according to a trade group, making it the nation’s largest renewable resource ahead of hydro.

Source: Wind capacity blows past hydro to become most plentiful US renewable | Utility Dive

After the release of a study showing solar now employs more than oil, gas and coal combined.

Rob Stavins is a leading environmental economists at Harvard. His blog was hacked after a post critical of Trump last fall. This is a repost of Stavins’ explanation.

Source: Environmental Economics: Standing by ‘An Economic View of the Environment’

William Nordhaus has long relied on traditional economic cost-benefit analysis to minimize the costs to the world economy from potential climate change impacts. This article discusses how he now views the increasing risk, the continuing uncertainty, and the likely increasing costs from delayed responses as driving the need for a more rapid effort.

Source: Why a climate economist is giving carbon’s ‘social cost’ a second look – CSMonitor.com

AMERICAN ECONOMIC REVIEW VOL. 107, NO. 1, JANUARY 2017

by Mark Egan, Ali Hortaçsu, and Gregor Matvos

We develop a structural empirical model of the US banking sector. Insured depositors and run-prone uninsured depositors choose between differentiated banks. Banks compete for deposits and endogenously default. The estimated demand for uninsured deposits declines with banks’ financial distress, which is not the case for insured deposits. We calibrate the supply side of the model. The calibrated model possesses multiple equilibria with bank-run features, suggesting that banks can be very fragile. We use our model to analyze proposed bank regulations. For example, our results suggest that a capital requirement below 18 percent can lead to significant instability in the banking system.

By Richard McCann

Why are we not using Davis’ wealth of human capital to our advantage? Why don’t we assign, and even hire or retain, these individuals to prepare these analyses for commission review?

By Anya McCann, COOL Cuisine

Altering your diet can alter the climate.

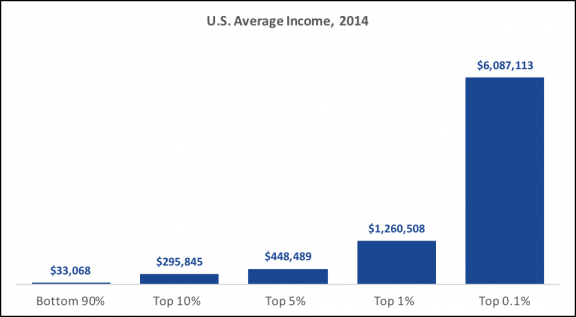

A recent article in the New York Times by Dierdre McCloskey boldly states that the answer to income inequality is to allow unfettered growth through free market forces. Unfortunately, this thesis comes straight out of the anti-Communist 1950s. McCloskey puts up a strawman that proponents of addressing inequality directly want to redistribute all wealth via grabbing all assets of the wealthy. Her version of how the economy has worked, and the policy proposals to address inequality are incorrect.

As I posted previously, we’ve already run the experiment comparing the performance of a market-based economy (West Germany) to a centrally-planned socialist economy (East Germany), and the market-based more than doubled the output of the socialist one. That said, the past West German (and the current German) is a far cry from a “free market” economy. It was and is heavily regulated with substantial redistributive policies. No one is seriously advocating that the U.S. move to a Communist economy (at least not since the 1950s)–they are suggesting that the U.S. consider policies that could redistribute wealth to improve the welfare of almost everyone.

Increased inequality has been found to decrease economic growth, contrary to McCloskey’s implied assertion. Both the OECD and IMF found negative consequences from increased wealth in the top 20% of households. Other studies show that historic U.S. GDP growth has not been impeded by high marginal tax rates, either for individual or corporate taxes.

She also misses the real reason as to why inequality is a concern. She dismisses it as simple envy. But it’s really about relative political and economic power. The wealthy are able to exert more bargaining power in economic transactions, and their greater influence on the political process is well documented.

As a side note, McCloskey appears to grossly underestimating the share of wealth and income held by the wealthiest segment of U.S. society. Her calculation appears to assume that wealth is distributed evenly across all of the income quintiles (“If we took every dime from the top 20 percent of the income distribution and gave it to the bottom 80 percent, the bottom folk would be only 25 percent better off.”) In fact, a recent estimate by the Federal Reserve Board shows that the top 0.1% of U.S. households hold over 40% of the wealth. That means that redistributing the wealth of just 0.1% will lead to a 40% increase in the wealth of everyone else. I’m not advocating such a radical solution, but it does demonstrate the potential scale of redistributive policies. For example, redistributing just 25% of the wealth of the richest 1% could lead to a 10% increase in the wealth of the remaining 99.9%.

All Things Solar and Electric

Musings from M.Cubed on the environment, energy and water

This blog is not necessarily about biking. It's about life that is lived locally, at a human pace.

Energy, Environment and Policy

Musings from M.Cubed on the environment, energy and water

Examining State Authority in Interstate Electricity Markets

Musings from M.Cubed on the environment, energy and water

Musings from M.Cubed on the environment, energy and water

Economic insight and analysis from The Wall Street Journal.

Musings from M.Cubed on the environment, energy and water

Musings from M.Cubed on the environment, energy and water

A few thoughts from John Fleck, a writer of journalism and other things, living in New Mexico

Musings from M.Cubed on the environment, energy and water

Musings from M.Cubed on the environment, energy and water

Musings from M.Cubed on the environment, energy and water

Tips and tricks on programming, evolutionary algorithms, and doing research

Musings from M.Cubed on the environment, energy and water

A blog about water resources and law

Musings from M.Cubed on the environment, energy and water