Republicans and Democrats demonstrate similar levels of scientific knowledge, but they have different trust levels for climate scientists and the media.

Source: 10 charts that explain America’s divide on energy and climate policy | Utility Dive

Republicans and Democrats demonstrate similar levels of scientific knowledge, but they have different trust levels for climate scientists and the media.

Source: 10 charts that explain America’s divide on energy and climate policy | Utility Dive

There’s one thing we all know: the Republican Party hates regulation. Republicans want to roll back some key regulations and make it a lot harder to pass new ones. But there’s a curi…

Source: Why Doesn’t the GOP Offer Alternative Solutions to Environmental Problems? | Legal Planet

The American Economic Journal: Applied Economics just published this article finding that a $1 cigarette tax reduces childho0d sick days at school by 10%. This demonstrates a strong link between second-hand smoke and public health, and how responsive cigarette demand is to a tobacco tax.

| (6) Does Early Life Exposure to Cigarette Smoke Permanently Harm Childhood Welfare? Evidence from Cigarette Tax Hikes |

| David Simon |

| Evidence suggests that excise taxes on tobacco improve fetal health. However, it remains unknown if smoke exposure in early life causes lasting harm to children. I find that in utero exposure to a dollar increase in the state cigarette tax causes a 10 percent decrease in sick days from school and a 4.7 percent decrease in having two or more doctor visits. I present additional evidence for decreases in hospitalizations and asthma. This supports the hypothesis that exposure to cigarette smoke in utero and infancy carries significant medium-term costs, and that excise taxes can lead to lasting intergenerational improvements in well-being. |

| Full-Text Access | Supplementary Materials |

In one version of the future utility-customer relationship that such a grid would make possible, customers might have a fixed monthly bill and long-term contract not unlike a cell phone service and the utility would provide, in addition to electricity, a suite of distributed resources, Julia Hamm, president of the Smart Electric Power Alliance (SEPA) said at a recent conference.In that future, more energy-smart consumers could choose to shop for private sector vendors to provide the solar, storage, and smart technologies — and they would be able to, Hamm said, because any vision of the electricity sector’s future should include choice.“We want this future,” Southern California Edison (SCE) President Ron Nichols said of Hamm’s description at the Solar Power International Conference. “We need to have a grid that can make that work.”

In one version of the future utility-customer relationship that such a grid would make possible, customers might have a fixed monthly bill and long-term contract not unlike a cell phone service and the utility would provide, in addition to electricity, a suite of distributed resources, Julia Hamm, president of the Smart Electric Power Alliance (SEPA) said at a recent conference.In that future, more energy-smart consumers could choose to shop for private sector vendors to provide the solar, storage, and smart technologies — and they would be able to, Hamm said, because any vision of the electricity sector’s future should include choice.“We want this future,” Southern California Edison (SCE) President Ron Nichols said of Hamm’s description at the Solar Power International Conference. “We need to have a grid that can make that work.”

Source: How Southern California Edison’s new rate case would transform the grid | Utility Dive

By Hannah Guzik The majority of health care expenses in California are paid for with public funds, a new study released Wednesday reports. The research counters the popular belief that corporations and individuals bear the brunt of health care costs. Researchers from the UCLA Center for Health Policy Research found that taxpayer dollars will pay […]

Source: Most Health Care Costs in California Are Paid With Public Funds – California Health Report

From the current issue of American Economics Review:

Robust Social Decisions: We propose and operationalize normative principles to guide social decisions when individuals potentially have imprecise and heterogeneous beliefs, in addition to conflicting tastes or interests. To do so, we adapt the standard Pareto principle to those preference comparisons that are robust to belief imprecision and characterize social preferences that respect this robust principle. [This paper focused on decisions related to climate change.]

Beyond GDP? Welfare across Countries and Time: We propose a summary statistic for the economic well-being of people in a country. Our measure incorporates consumption, leisure, mortality, and inequality, first for a narrow set of countries using detailed micro data, and then more broadly using multi-country datasets. While welfare is highly correlated with GDP per capita, deviations are often large. Western Europe looks considerably closer to the United States, emerging Asia has not caught up as much, and many developing countries are further behind. Each component we introduce plays a significant role in accounting for these differences, with mortality being most important.

(W)hat proportion of consumption in the United States, given the US values of leisure, mortality, and inequality, would deliver the same expected utility as the values in France? In our results, lower mortality, lower inequality, and higher leisure each add roughly 10 percentage points to French welfare in terms of equivalent consumption. Rather than looking like 60 percent of the US value, as it does based solely in consumption, France ends up with consumption-equivalent welfare equal to 92 percent of that in the United States.

A summary:

(i) GDP per person is an informative indicator of welfare across a broad range of countries: the two measures have a correlation of 0.98. Nevertheless, there are economically important differences between GDP per person and consumption-equivalent welfare. Across our 13 countries, the median deviation is around 35 percent—so disparities like we see in France are quite common.

(ii) Average Western European living standards appear much closer to those in the United States (around 85 percent for welfare versus 67 percent for income) when we take into account Europe’s longer life expectancy, additional leisure time, and lower inequality.

(iii) Most developing countries—including much of sub-Saharan Africa, Latin America, southern Asia, and China—are substantially poorer than incomes suggest because of a combination of shorter lives and extreme inequality. Lower life expectancy reduces welfare by 15 to 50 percent in the developing countries we examine. Combined with the previous finding, the upshot is that, across countries, welfare inequality appears even greater than income inequality.

(iv) Growth rates are typically revised upward, with welfare growth averaging 3.1 percent between the 1980s and the mid-2000s versus income growth of 2.1 percent. A boost from rising life expectancy of more than a percentage point shows up throughout the world, with the notable exception of sub-Saharan Africa. When welfare grows 3 percent instead of 2 percent per year, living standards double in 24 years instead of 36 years; over a century, this leads to a 20-fold increase rather than a 7-fold increase.

Bailouts, Time Inconsistency, and Optimal Regulation: A Macroeconomic View: A common view is that bailouts of firms by governments are needed to cure inefficiencies in private markets. We propose an alternative view: even when private markets are efficient, costly bankruptcies will occur and benevolent governments without commitment will

bail out firms to avoid bankruptcy costs. Bailouts then introduce inefficiencies where none had existed. Although granting the government orderly resolution powers which allow it to rewrite private contracts improves on bailout outcomes, regulating leverage and taxing size is needed to achieve the relevant constrained efficient outcome, the sustainably efficient outcome.

Long-Run Risk Is the Worst-Case Scenario: We study an investor who is unsure of the dynamics of the economy. Not only are parameters unknown, but the investor does not even know what order model to estimate. She estimates her consumption process nonparametrically…and prices assets using a pessimistic model that minimizes lifetime utility subject to a constraint on statistical plausibility…[A] way of interpreting our results is that they say that what people fear most, and what makes them averse to investing in equities, is that growth rates or asset returns are going to be persistently lower over the rest of their lives than they have been on average in the past.

An interesting discussion about the failures and lessons for broad scale retraining programs.

My own thought is that we need to buy out the homes of displaced workers at the higher of either their purchase cost or the assessed value to facilitate moving to a new job location.

Source: Where Should All the Coal Miners Go? – Pacific Standard

I was struck by the juxtapose of these two items:

California has many progressive and necessary regulations, but the state does an awful job of administering them. Too often, the bureaucrats are too wrapped up in believing the process is actually important. Instead, they should be thinking about how they can ease the permitting and compliance process so that businesses can focus on achieving everyone’s goals.

A bureaucrat should be filling in the missing blanks rather than waiting for months to kick back an application. A friend noted the all too common “NIGO” response–“not in good order.” Being NIGO’d is not conducive to good business.

Davis has not been able to develop larger tracts of land to attract firms working on innovation and partnering with UC Davis. Opponents of several proposed projects have claimed that developers can instead assemble the numerous infill parcels that already exist within city limits to create the needed innovation parks. Now a new study in the leading journal, American Economics Review, finds that in Los Angeles, assembling a group of parcels for such projects faces sale prices 15% to 40% more than a single parcel project. And that doesn’t include the typical per parcel transaction costs that are compounded by multiple purchases. The bottom line is that infill development for larger projects face a high cost premium that must be acknowledged.

Davis has not been able to develop larger tracts of land to attract firms working on innovation and partnering with UC Davis. Opponents of several proposed projects have claimed that developers can instead assemble the numerous infill parcels that already exist within city limits to create the needed innovation parks. Now a new study in the leading journal, American Economics Review, finds that in Los Angeles, assembling a group of parcels for such projects faces sale prices 15% to 40% more than a single parcel project. And that doesn’t include the typical per parcel transaction costs that are compounded by multiple purchases. The bottom line is that infill development for larger projects face a high cost premium that must be acknowledged.

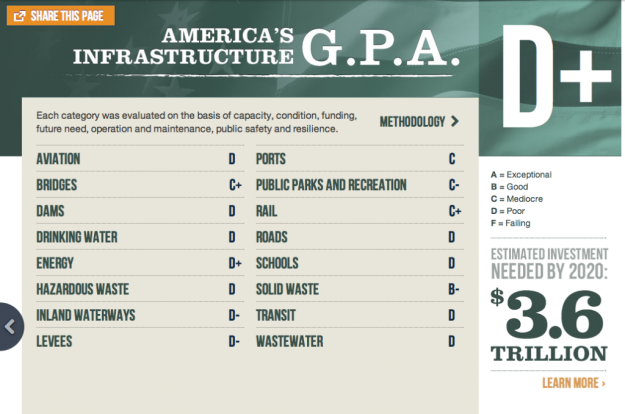

At the core of the dissatisfaction driving support for Brexit, Donald Trump (and Bernie Sanders) is economic dislocation that reduced the jobs and wages of those who worked in the manufacturing and construction industries. The solution is NOT to return to retail manufacturing, where the U.S. can’t compete with China; nor is it to extract more fossil fuels in a highly volatile energy market or to build houses for another financial bubble. Instead we can address their needs while solving a different crisis–fixing our crumbling infrastructure, and even get some other ancillary benefits. We would have both construction and heavy manufacturing jobs with good wages, aimed right at the Brexit/Trump constituencies. And there would be little foreign competition while we put the U.S. economy on better footing to compete in other sectors.

The American Society of Civil Engineers estimate that America needs $3.6 trillion of investment in replacing our infrastructure such as roads, waterworks, power and gas lines and the rest that makes American go. This sounds like a big number, but it’s only a bit more than half of what all federal, state and local governments spend annually. Of course, we would never pay for all of this at once. In our current low-interest environment, at 3% bond financing over 30 years, the annual cost would be $180 billion, which is less than 3% of total spending.

The key is to use disciplined deficit spending, i.e., bonded indebtedness, to finance this program. Funds should be earmarked specifically for this program at the federal, state and local levels. One source of funds could be a wealth tax. A tax rate of 0.2% (yes, two tenths of a percent) on registered securities and real estate could cover the annual debt repayments.

We could tie this program to two other possible goals:

All Things Solar and Electric

Musings from M.Cubed on the environment, energy and water

This blog is not necessarily about biking. It's about life that is lived locally, at a human pace.

Energy, Environment and Policy

Musings from M.Cubed on the environment, energy and water

Examining State Authority in Interstate Electricity Markets

Musings from M.Cubed on the environment, energy and water

Musings from M.Cubed on the environment, energy and water

Economic insight and analysis from The Wall Street Journal.

Musings from M.Cubed on the environment, energy and water

Musings from M.Cubed on the environment, energy and water

A few thoughts from John Fleck, a writer of journalism and other things, living in New Mexico

Musings from M.Cubed on the environment, energy and water

Musings from M.Cubed on the environment, energy and water

Musings from M.Cubed on the environment, energy and water

Tips and tricks on programming, evolutionary algorithms, and doing research

Musings from M.Cubed on the environment, energy and water

A blog about water resources and law

Musings from M.Cubed on the environment, energy and water