From the current issue of American Economics Review:

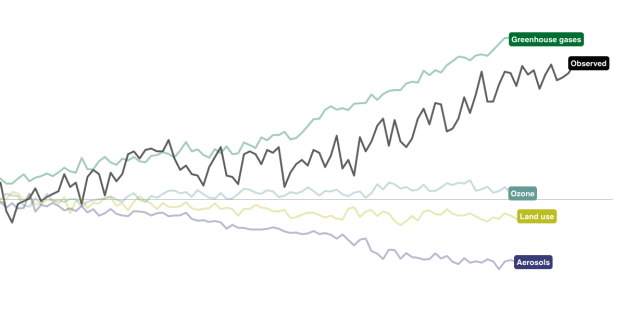

Robust Social Decisions: We propose and operationalize normative principles to guide social decisions when individuals potentially have imprecise and heterogeneous beliefs, in addition to conflicting tastes or interests. To do so, we adapt the standard Pareto principle to those preference comparisons that are robust to belief imprecision and characterize social preferences that respect this robust principle. [This paper focused on decisions related to climate change.]

Beyond GDP? Welfare across Countries and Time: We propose a summary statistic for the economic well-being of people in a country. Our measure incorporates consumption, leisure, mortality, and inequality, first for a narrow set of countries using detailed micro data, and then more broadly using multi-country datasets. While welfare is highly correlated with GDP per capita, deviations are often large. Western Europe looks considerably closer to the United States, emerging Asia has not caught up as much, and many developing countries are further behind. Each component we introduce plays a significant role in accounting for these differences, with mortality being most important.

(W)hat proportion of consumption in the United States, given the US values of leisure, mortality, and inequality, would deliver the same expected utility as the values in France? In our results, lower mortality, lower inequality, and higher leisure each add roughly 10 percentage points to French welfare in terms of equivalent consumption. Rather than looking like 60 percent of the US value, as it does based solely in consumption, France ends up with consumption-equivalent welfare equal to 92 percent of that in the United States.

A summary:

(i) GDP per person is an informative indicator of welfare across a broad range of countries: the two measures have a correlation of 0.98. Nevertheless, there are economically important differences between GDP per person and consumption-equivalent welfare. Across our 13 countries, the median deviation is around 35 percent—so disparities like we see in France are quite common.

(ii) Average Western European living standards appear much closer to those in the United States (around 85 percent for welfare versus 67 percent for income) when we take into account Europe’s longer life expectancy, additional leisure time, and lower inequality.

(iii) Most developing countries—including much of sub-Saharan Africa, Latin America, southern Asia, and China—are substantially poorer than incomes suggest because of a combination of shorter lives and extreme inequality. Lower life expectancy reduces welfare by 15 to 50 percent in the developing countries we examine. Combined with the previous finding, the upshot is that, across countries, welfare inequality appears even greater than income inequality.

(iv) Growth rates are typically revised upward, with welfare growth averaging 3.1 percent between the 1980s and the mid-2000s versus income growth of 2.1 percent. A boost from rising life expectancy of more than a percentage point shows up throughout the world, with the notable exception of sub-Saharan Africa. When welfare grows 3 percent instead of 2 percent per year, living standards double in 24 years instead of 36 years; over a century, this leads to a 20-fold increase rather than a 7-fold increase.

Bailouts, Time Inconsistency, and Optimal Regulation: A Macroeconomic View: A common view is that bailouts of firms by governments are needed to cure inefficiencies in private markets. We propose an alternative view: even when private markets are efficient, costly bankruptcies will occur and benevolent governments without commitment will

bail out firms to avoid bankruptcy costs. Bailouts then introduce inefficiencies where none had existed. Although granting the government orderly resolution powers which allow it to rewrite private contracts improves on bailout outcomes, regulating leverage and taxing size is needed to achieve the relevant constrained efficient outcome, the sustainably efficient outcome.

Long-Run Risk Is the Worst-Case Scenario: We study an investor who is unsure of the dynamics of the economy. Not only are parameters unknown, but the investor does not even know what order model to estimate. She estimates her consumption process nonparametrically…and prices assets using a pessimistic model that minimizes lifetime utility subject to a constraint on statistical plausibility…[A] way of interpreting our results is that they say that what people fear most, and what makes them averse to investing in equities, is that growth rates or asset returns are going to be persistently lower over the rest of their lives than they have been on average in the past.

This

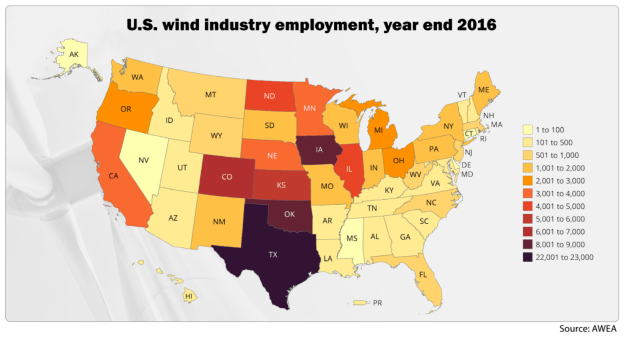

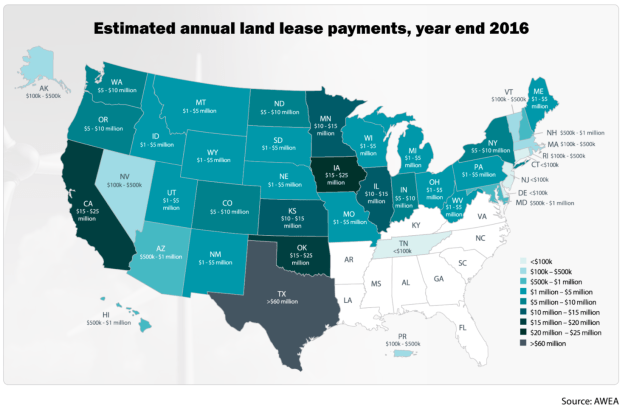

This Lawrence Berkeley National Laboratory released its 2015 market assessment with almost shocking results. New wind projects are now reaching capacity factors in excess of 40% and PPA prices are at $20/MWH. More than 8,500 MW was installed last year. More at the website below, including the data set and Powerpoint slides.

Lawrence Berkeley National Laboratory released its 2015 market assessment with almost shocking results. New wind projects are now reaching capacity factors in excess of 40% and PPA prices are at $20/MWH. More than 8,500 MW was installed last year. More at the website below, including the data set and Powerpoint slides.