The California Legislature is considering a bill (AB 893) that would require the state’s regulated utilities (including CCAs as well as investor-owned) to buy at least 4,250 megawatts of renewables before federal tax credits expire in 2022.

Unfortunately, this will not create the cost savings that seem so obvious. This argument was made by the renewable energy plant owners in the Diablo Canyon Power Plant retirement case (A.16-08-006) and rejected by the CPUC in its decision. While the tax credits lower current costs, these are more than offset by waiting for technology costs to fall even further, as shown by the solar power forecast above. Combined with the time value of money (discounting), the value of waiting far outweighs prematurely buying renewables.

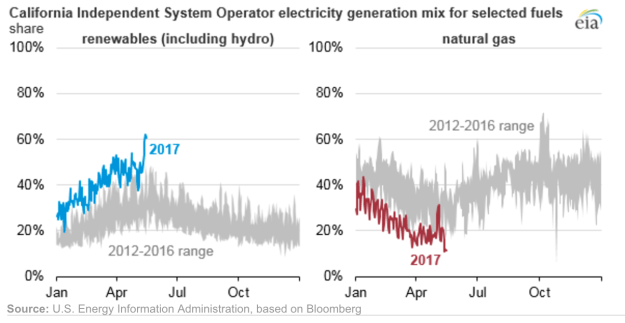

The legislature already passed a bill (SB 1090) that requires the CPUC to ensure that GHG emissions will not rise when Diablo Canyon retires in 2024 and 2025 when approving integrated resource plans. (Whether the governor signs this overly directive law is another question.) And SB 100 requires reaching 100% carbon free by 2045. A study just released by the Energy Institute at Haas indicates that renewables to date have depressed energy market prices, discouraging further investment. And the CAISO is “managing oversupply” created by the current renewable generation.

And there’s a further problem–with a large number of customers moving from the IOUs to CCAs across all three utilities, the question is “who should be responsible for buying this power?” The CCAs will have their own preferences (often locally and community-scale) that will conflict with any choices made by the IOUs. The CCAs are already saddled with poor procurement and portfolio management decisions by the IOUs through exit fees. (PG&E has an embedded risk premium of $33 per megawatt-hour in its RPS portfolio costs.) Why would we want the IOUs to continue to mismanage our power resources?

Panel imports were up

Panel imports were up